Being a homeowner comes with many responsibilities and challenges. From managing finances to ensuring that your home is safe and comfortable, it can be a lot to handle. One of the biggest challenges of homeownership is budgeting. With so many expenses to account for, it can be hard to make sure that your money is going toward the right things. In this blog, we’ll provide budgeting advice to help you make the most of your home ownership experience.

Preventative Maintenance and Repairs

One of the most important parts of budgeting as a homeowner is to plan for preventative maintenance and repairs. This includes hiring a Schaumburg plumber, electrician, and any other necessary repair professionals to keep your home in good condition. It can be easy to forget about these expenses when you’re planning your budget, but they can add up quickly. Try to set aside a portion of your budget each month for maintenance and repairs so that you’re prepared for any potential issues.

Shopping for Home Goods

When you’re budgeting for your home, it’s important to remember that you’ll need to go shopping in Central Jersey or elsewhere from time to time to stock up on home supplies. This includes items such as furniture, appliances, and décor. When shopping for home goods, you should always compare prices and look for the best deal. You can also save money by looking for sales and discounts. With a little bit of research and planning, you can find great deals on home goods and stay within your budget.

Budget for Necessities

Budgeting for your necessities as a homeowner is essential to keeping your home in good condition and your finances in order. It is important to create a budget and stick to it, so you can keep up with any repairs or purchases you need to make for your home. With a little planning and budgeting, you can ensure that your home is taken care of and that you remain financially secure.

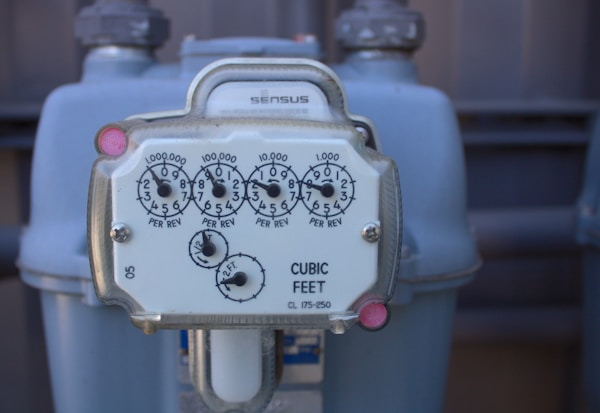

Utilities and Other Expenses

Budgeting for utilities and other expenses can be a challenge, but it’s essential for keeping your home comfortable and running smoothly. Be sure to research the rates for your area and factor in any additional fees and expenses associated with running your home. By doing this, you can make sure that you’re prepared for any unexpected costs and that you’re able to budget for these essential items.

Insurance

Insurance is another important part of budgeting for your home. Homeowners insurance is necessary to protect your home and your belongings. Be sure to shop around for the best rates to ensure that you’re getting the most coverage for your money. Additionally, some states require homeowners to have additional insurance, such as flood insurance. Be sure to check with your local government to find out what type of insurance is required in your area.

Saving for Emergencies

The best way to prepare for unexpected expenses is to set aside a portion of your budget specifically for this purpose. This way, if something does come up, you’ll have money already set aside to cover it. This is especially important for homeowners, as unexpected repairs can be a large part of homeownership. By setting aside a portion of your budget for unexpected expenses in an emergency savings fund, you can be more prepared for anything that might come up.

Budgeting for your home can be a daunting task. However, with a bit of planning and research, you can make sure that your money is going toward the right things. Be sure to plan for preventative maintenance and repairs, shop around for home goods, budget for utilities and other expenses, purchase insurance, and set aside money for emergencies. By following these steps, you can make sure that your home ownership experience is as stress-free as possible.